User:SurabhiSri/Investment

| This is the sandbox page where you will draft your initial Wikipedia contribution.

If you're starting a new article, you can develop it here until it's ready to go live. If you're working on improvements to an existing article, copy only one section at a time of the article to this sandbox to work on, and be sure to use an edit summary linking to the article you copied from. Do not copy over the entire article. You can find additional instructions here. Remember to save your work regularly using the "Publish page" button. (It just means 'save'; it will still be in the sandbox.) You can add bold formatting to your additions to differentiate them from existing content. |

Article Draft[edit]

Lead[edit]

Article body[edit]

Growth Investing

Growth investors seek investments that they believe are likely to have higher earnings or greater value in the future. To identify such stocks, growth investors often evaluate measures of current stock value as well as predictions of financial performance in the future[1]. Growth investors seek profits through capital appreciation – the gains earned when a stock is sold at a higher price than what it was purchased for. The price-to-earnings (P/E) multiple is also used for this type of investment; growth stock are likely to have a P/E higher than others in its industry[2]. According to Investopedia author Troy Segal and U.S. Department of State Fulbright fintech research awardee Julius Mansa, growth investing is best suited for investors who prefer relatively shorter investment horizons, higher risks, and aren’t seeking immediate cash flow through dividends.[1]

Some investors attribute the introduction of the growth investing strategy to investment banker Thomas Rowe Price Jr., who tested and popularized the method in 1950 by introducing his mutual fund, the T. Rowe Price Growth Stock Fund. Price asserted that investors could reap high returns by “investing in companies that are well-managed in fertile fields.”[3]

Momentum Investing

Momentum investors generally seek to buy stocks that are currently experiencing a short-term uptrend, and they usually sell them once this momentum starts to decrease. Stocks or securities purchased for momentum investing are often characterized by demonstrating consistently high returns for the past three to twelve months.[4] However, in a bear market, momentum investing also involves short-selling securities of stocks that are experiencing a downward trend, because it is believed that these stocks will continue to decrease in value. Essentially, momentum investing generally relies on the principle that a consistently up-trending stock will continue to grow, while a consistently down-trending stock will continue to fall.

Economists and financial analysts have not reached a consensus on the effectiveness of using the momentum investing strategy. Rather than evaluating a company’s operational performance, momentum investors instead utilize trend lines, moving averages, and the Average Directional Index (ADX) to determine the existence and strength of trends.[5]

Dollar-Cost Averaging

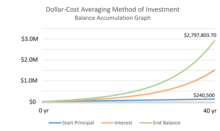

Dollar-cost averaging (DCA), also known in the UK as pound-cost averaging, is the process of consistently investing a certain amount of money across regular increments of time, and the method can be used in conjunction with value investing, growth investing, momentum investing, or other strategies. For example, an investor who practices dollar-cost averaging could choose to invest $200 a month for the next 3 years, regardless of the share price of their preferred stock(s), mutual funds, or exchange-traded funds.

Many investors believe that dollar-cost averaging helps minimize short-term volatility by spreading risk out across time intervals and avoiding market timing.[5] Research also shows that DCA can help reduce the total average cost per share in an investment because the method enables the purchase of more shares when their price is lower, and less shares when the price is higher.[5] However, dollar-cost averaging is also generally characterized by more brokerage fees, which could decrease an investor’s overall returns.

The term “dollar-cost averaging” is thought to have first been coined in 1949 by economist and author Benjamin Graham in his book, The Intelligent Investor. Graham asserted that investors that use DCA are “likely to end up with a satisfactory overall price for all [their] holdings.”[6]

References[edit]

- ^ a b "Is Growth Investing the Right Money-Making Method for You?". Investopedia. Retrieved 2022-10-05.

- ^ Chandler, Simon. "A growth stock is a company expected to rise faster than the overall market, offering bigger gains for investors who don't mind risk". Business Insider. Retrieved 2022-10-05.

- ^ Chan, Louis K.C.; Lakonishok, Josef (2004-01). "Value and Growth Investing: Review and Update". Financial Analysts Journal. 60 (1): 71–86. doi:10.2469/faj.v60.n1.2593. ISSN 0015-198X.

{{cite journal}}: Check date values in:|date=(help) - ^ "Momentum Investing". The Balance. Retrieved 2022-10-05.

- ^ a b c "Investment Strategies to Learn Before Trading". Investopedia. Retrieved 2022-10-05.

- ^ 1894-1976., Graham, Benjamin, (2003). The intelligent investor : a book of practical counsel. HarperBusiness Essentials. OCLC 1035152456.

{{cite book}}:|last=has numeric name (help)CS1 maint: extra punctuation (link) CS1 maint: multiple names: authors list (link)